If your credit is suffering from repeated late payments or bankruptcy, you may have to wait for some time for improvement. Some of them can be simple fixes such as paying down balances and any open collections. You can get prequalified for a bigger mortgage by improving on your credit score if that’s the factor that is holding you back. How You Can Improve Your Prequalification However, a prequalification is more informal, whereas your preapproval letter is good for about three months, after which point you may have to submit paperwork again.

The calculator also includes built-in mini-calculators for totaling up your gross income, monthly debt payments, and estimated homeowners insurance premiums. Prequal vs preapproval It often depends on. This calculator will calculate whether or not you would qualify for a home loan, and if so, how much of a home loan you might be qualifying for. The prequalification and preapproval process can take just one day depending on how quickly you can get your information and documentation the lender. How much house can I afford Learn the difference between a mortgage prequalification and mortgage preapproval.

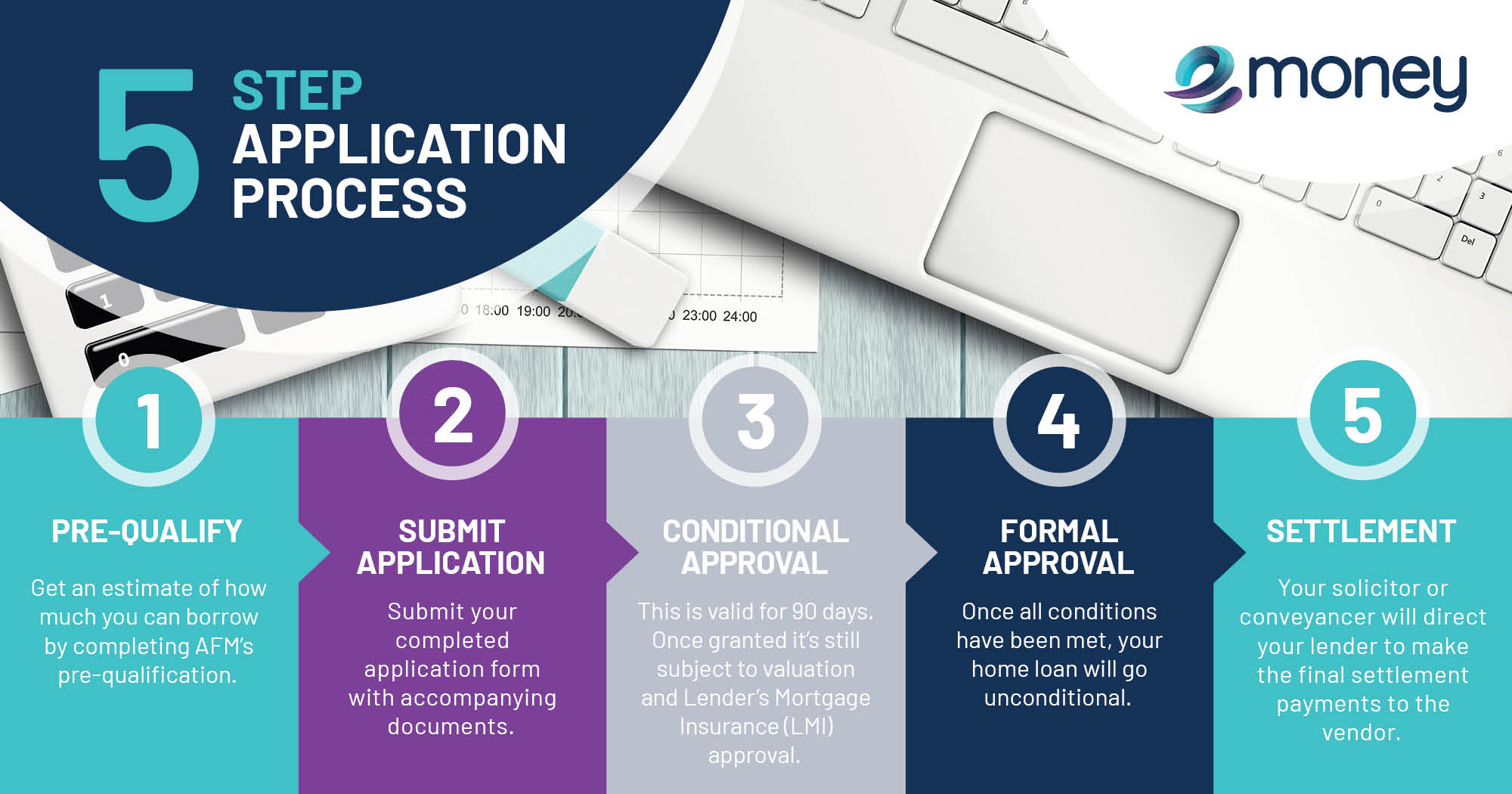

The preapproval process is much more official than prequalification and involves pulling your credit and submitting pay stubs and other income documentation. With a preapproval letter from a bank, you can make a serious offer on a property, showing that you are a buyer with credentials and have passed the first serious step in obtaining a mortgage. They are actually similar, but preapproval is a much more crucial step when you want to be one step closer to purchasing your home. Preapproval and prequalification sounds like nearly the same thing. PropertyNest’s Prequalification Mortgage calculator also factors in the DTI to approximate your buying power. Most lenders feel comfortable with applicants who have less than a 36% debt-to-income ratio or a DTI. Your monthly debt gets used as true measure against your monthly gross income when it comes to financial institutions. Looking at income is just one of the components that is used to determine your buying power. It can be an eye-opening step to not only deem if you are ready to buy, but how much you can actually spend. Going through the process will help the lender determine if you have the necessary criteria in terms of income, credit, and debt. Understanding What a Prequalification isĪ mortgage prequalification is something you work through with a lender or bank. You will be contacted shortly to be connected with a local real estate expert.

0 kommentar(er)

0 kommentar(er)